Fünf Tipps zum Verwalten Ihres Guthabens für verzögerte Zahlungen

Mit der Funktion „Jetzt buchen – später zahlen“ können ausgewählte Reisebüros eine Unterkunft buchen und sich die Rate sichern, ohne sofort bezahlen zu müssen. Stattdessen wird dafür ein Guthaben genutzt und die tatsächliche Zahlung auf einen späteren Termin aufgeschoben.

Verzögerte Zahlungen bieten ausgewählten Reisebüros die Möglichkeit, eine Unterkunft zum Tarif mit Vorauszahlung zu buchen, für die eigentlich eine sofortige Zahlung erforderlich wäre, und erst bis zu sieben Tage vor der Stornierungsfrist der Unterkunft zu bezahlen. Jedem teilnahmeberechtigten Reisebüro wird Guthaben für diese Art von Buchungen zugewiesen. Wenn die Zahlung dann fällig ist, wird der entsprechende Betrag von der Kreditkarte abgebucht, die bei der Buchung angegeben wurde (dies kann die Karte des Reisebüros oder die des Reisenden sein). Dieser Betrag wird dann wieder Ihrem Guthaben für verzögerte Zahlungen gutgeschrieben.

Um zu erfahren, wie Sie eine Buchung mit verzögerter Zahlung vornehmen, lesen Sie unsere Schritt-für-Schritt-Anleitung.

Wenn Sie anfangen, verzögerte Zahlungen zu verwenden, empfehlen wir Ihnen diese Best Practices, damit Sie mehr von Ihrem Guthaben haben.

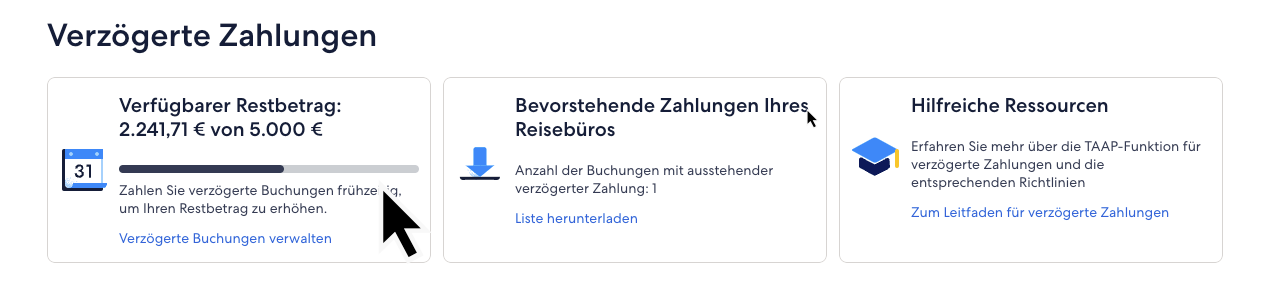

1. Behalten Sie Ihr Guthaben im Blick

Werden Sie nicht davon überrascht, dass Ihr Guthaben verbraucht ist. Auf der Homepage von Expedia TAAP können Sie einsehen, welcher Betrag Ihrem Reisebüro aktuell zur Verfügung steht. Dies ist die effektivste Möglichkeit, Ihre Ausgaben zu verwalten und zu ermitteln, ob Sie Zahlungen vornehmen oder Zahlungsdaten anpassen sollten.

2. Nutzen Sie Berichte

Ein guter Überblick über ausstehende Zahlungen kann Sie enorm dabei unterstützen, Ihr Guthaben für verzögerte Zahlungen im Griff zu behalten. Im Bericht über unbezahlte Buchungen finden Sie alle relevanten Informationen auf einen Blick. Klicken Sie einfach auf der Expedia TAAP-Startseite auf Liste herunterladen, um auf diesen Bericht zuzugreifen.

3. Vereinbaren Sie Zahlungstermine mit Ihren Kunden

Standardmäßig ist das Zahlungsdatum auf sieben Tage vor Ablauf der Stornierungsfrist festgelegt. Der Betrag einer Buchung ist gebunden, bis die Zahlung geleistet wurde. Alternativ können Sie jedoch auch zum Zeitpunkt der Buchung einen Zahlungstermin mit Ihren Kunden vereinbaren, damit der Buchungsbetrag früher wieder frei wird. Sollten Reisende einmal nicht in der Lage sein, zum vereinbarten Termin zu zahlen, können Sie den Zahlungstermin immer verschieben, auf bis zu sieben Tage vor Ablauf der Stornierungsfrist.

4. Bezahlen Sie früher

Wenn sich Ihr Guthaben dem Ende zuneigt, können Sie gebundenes Guthaben wieder freigeben, indem Sie Buchungen bezahlen. Auch wenn Expedia TAAP automatisch einen Zahlungstermin für Buchungen festlegt, sind Sie absolut flexibel und können diesen Termin ganz einfach ändern – so oft wie nötig. Indem Sie den Zahlungstermin nach vorne verlegen, können Sie gebundenes Guthaben für verzögerte Zahlungen wieder freigeben.

Falls Sie für die Buchung die Kreditkarte eines Reisenden und nicht die Ihres Reisebüros verwendet haben, sollten Sie sich allerdings an die getroffenen Vereinbarungen halten – wenn Sie den Zahlungstermin ohne Absprache mit den Reisenden ändern, könnte das eine Beschwerde nach sich ziehen. Um zu erfahren, wie das geht, lesen Sie unsere Schritt-für-Schritt-Anleitung, wie Sie eine Buchung mit verzögerter Zahlung ändern.

5. Behalten Sie den Überblick mit unseren Benachrichtigungen

Angesichts prall gefüllter To-do-Listen und vieler Kunden passiert es nur zu leicht, dass ein Zahlungstermin unbemerkt verstreicht. Deshalb empfehlen wir Ihnen dringend, die Benachrichtigungen auf unserer Startseite und die E-Mails, die wir Ihnen senden, im Blick zu haben. Diese können wichtige Informationen über fehlgeschlagene verzögerte Zahlungen enthalten, die sich auf die Buchung auswirken könnten. Vergessen Sie nicht, auch Ihre Spam-/Junk-Ordner zu prüfen.